Opera Programming for a Changed World

Jamie Alexander

Director, JCA Arts Marketing

We’ve been through a lot since opera companies went dark in March 2020. A pandemic, racial reckoning, financial crisis, an election, an insurrection, and the near halt of in-person socialization. As a result, we’ve all changed. When we resume life without social distancing and masks, it’s likely our appetite for social outings, and the kinds of art we consume, will change too.

Accordingly, as opera companies plan for the reopening of their doors, programming will need to reflect these changes—not only to accommodate different behavior amongst prior audience members, but also to be inclusive and equitable to those who have existed in the margins of opera’s historically white European roots. We’ve long known that opera needed a programmatic shift to engage fresh audiences and be inclusive of all, and the state of the world now is speeding up the inevitable.

Programming adjustments have already shown up in the upcoming season line-ups of the country’s foremost opera companies:

- The Metropolitan Opera will open the 2021/22 season with Fire Shut Up in My Bones, the first opera produced at the Met by a Black composer (Terrence Blanchard) and directed by a Black director (Camille A. Brown).

- Lyric Opera of Chicago is inviting audiences to witness the creation of a new work that incorporates operatic singing with hip-hop, barbershop, gospel, funk, neo soul, and R&B music.

- Opera Philadelphia launched OperaPhila.tv an app for its inventive digital commissions. Which, even after the pandemic, will exist along-side its in-person performances.

However, the question of how programming needs to be adjusted for reopening isn’t just about what title is on stage. It’s also about:

- What is the correct balance of in-person vs digital performances?

- Who are the artists? Do audiences prefer resident artists, guest artists, or stars?

- How many performances should you have of each production?

- What time of day and day of week should performances be?

- Do you need to program shows without intermission for social distancing?

- How much should you charge for tickets?

- What programming will generate the most income?

But how do you answer these questions and program a season for an unknown world? How can you anticipate how audiences will react to your programming?

THE DISCOUNTED VALUE OF HISTORIC DATA

Usually, to address these programming questions, we’d recommend turning to historical data. A deep dive into your transactional data will typically tell you who is in your audience and how they behave, and those insights will help inform your programming decisions for the future.

However, the value of historic transactional data is discounted right now. That data reflects the old world. As a result, advanced primary research on consumer behavior is absolutely critical to making programming decisions in unknown territory. The primary research technique we recommend is conjoint analysis.

PRIMARY RESEARCH IS KING

A conjoint analysis is renowned for its ability to predict consumer behavior. We all know that what people SAY they will do is much different from what they will ACTUALLY do, and conjoint analysis uses decision modeling to project how people will actually behave. A conjoint analysis replicates the purchase experience by forcing people to make decisions between a variety of different options. By analyzing this kind of decision making, you can see what people really value.

Conjoint analysis is a highly popular statistical tool, used by many industries looking to test ideas before going to market. Here’s an example of why Volkswagen used conjoint analysis.

In the case of opera, conjoint analysis can help you understand the decisions people make when purchasing an opera ticket: Do they care about title, or getting a good seat? Will they pay $200 a seat in the orchestra, or $50 for a seat in the balcony? Will they still buy a ticket for a Thursday night show, or only for Saturday night shows?

CONJOINT ANALYSIS FOR INCLUSION

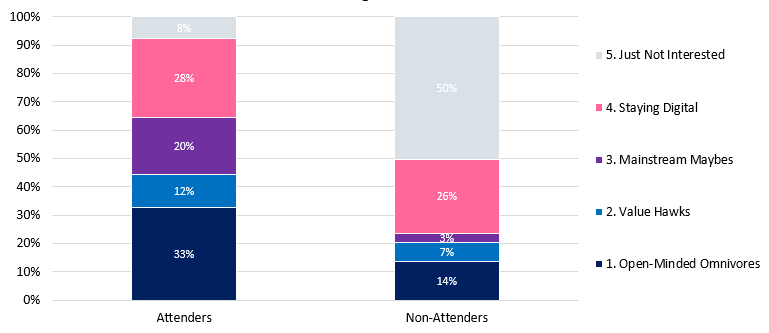

One of the most beneficial aspects of a conjoint analysis is that it allows you to segment results to uncover preferences and behaviors of a variety of audience segments. For example, for a recent study we did with Arizona Opera, we found five dominant segments in its current and potential audience:

These segments relate to each audience member’s interest in attending, for what type of programming, and at what price point. We also were able to integrate attitudes regarding COVID to these segments, so know which are likely to return at what stages of reopening. By breaking to down the current and potential audience into segments as above, an organization can better curate a season and focus its marketing efforts.

Segmentation is important when surveying current audience members, and can also be used to understand the values of traditionally underserved audiences and those not already in your database. We recommend getting a census-balanced panel of respondents in the geographical area you serve, to understand the motivators of those in your larger community, as well as your market potential.

After surveying potential audience, you can break down those results by statistical segmentation (or by any combination of variables) to understand what programming decisions will drive audience growth and inclusivity of historically underserved audiences.

RESULTS & IMPLICATIONS ON PROGRAMMING

Conjoint analysis produces a huge amount of data which, when configured cleverly, will inform your programmatic decisions. Melbourne Symphony Orchestra recently conducted a conjoint analysis with our partners, Baker Richards, to design its 2021 season. Through the analysis, the company learned:

- What a balanced season would look like in terms of repertoire (50% classics, 25% 19th century favorites, and 25% 20th century marvels).

- Patrons are more attracted by the prospect of seeing MSO soloists.

- For social distancing, demands warrants having two performances a night with no intermission.

- The ideal price points, in line with its customer’s willingness to pay, are $141 at the top end and $67 at the low end.

- By overlaying each customer’s willingness to pay against their preferred section of the theatre, the company determined what proportion of each section should be high and low priced.

Ultimately, Melbourne Symphony Orchestra walked away from the study equipped with the relevant evidence to make informed decisions about its season programming. Read the full case study here.

LOOPING BACK TO HISTORICAL DATA

When theatres reopen and ticket sales resume, historical transactional data will once again earn its digital weight in gold. You’ll be able to analyze how your audience actually behaves, and the changes in behavior that result from the changes in our world. This will be a critical time to closely examine audience behavior, and make adjustments as you forge ahead.

MOVING FORWARD

We’ve known for a long time that a change was needed in operatic programming to engage fresh audiences and be inclusive of all. The pandemic and racial justice movement have pushed us to move faster toward that change, and conjoint analysis can help light the path.

For more information about analysis for programming optimization, see our Patron Preference Analysis, which makes use of conjoint analysis, or contact us.

Industry Insights, Delivered Directly

Sign up for our JCA Arts Marketing newsletter to receive marketing insights, including advice for COVID-19 recovery and pricing best practices.